CRED Ventures into Wealth Management: Acquisition Talks with Kuvera Underway

In an exciting move signaling CRED’s expanding interest in the world of stock investments and mutual funds, the Indian fintech giant is in talks to acquire Kuvera, an online wealth management platform. The potential deal, which is expected to be finalized within weeks, showcases CRED’s determination to tap into the lucrative category of investment opportunities.

Kuvera, founded by industry veterans seven years ago, has garnered a loyal customer base in India with its zero commission offering, reliable customer support, and a comprehensive range of investment tools. Notably, the platform’s ability to automatically adjust portfolios and mitigate overreliance on specific assets has attracted affluent customers looking for stable and conservative long-term investments.

With an AUM of approximately $1.4 billion, Kuvera has raised around $10 million in funding to date. The platform also allows users to invest in stocks, including US-listed options, as well as fixed deposits. Its partnership with notable firms such as Amazon further highlights its position as a trusted player in the market.

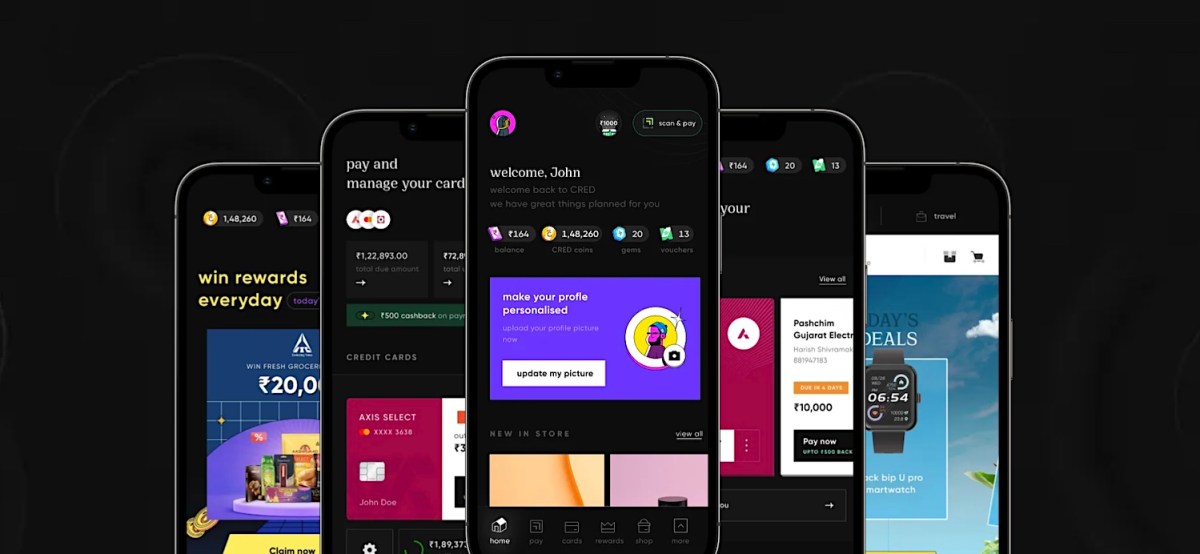

CRED’s interest in Kuvera aligns with the company’s ongoing efforts to broaden its wealth management offerings. The fintech giant, which initially launched as a platform for timely credit card bill payments, has rapidly expanded its services to e-commerce and lending. Valued at over $6 billion, CRED aims to cater to the needs of its affluent customer base and capitalize on the vast potential presented by the mutual fund market.

In India, mutual funds have emerged as a highly profitable sector, with the industry’s AUM currently exceeding $575 billion, marking a 20% growth from the previous year. The country’s expanding middle class, coupled with higher disposable incomes and increased financial literacy, has contributed to the surging popularity of mutual funds. Furthermore, the widespread adoption of digital apps and the allure of historical returns have solidified the appeal of mutual funds among Indian investors.

Speaking about the immense growth potential, HSBC noted, “At the end of 2022, less than 10% of households’ financial assets were in the form of equity and fund products. But this is changing given the growing popularity of systematic investment plans, the rising popularity of insurance products, and the growing adoption of credit cards and other financial products.”

While previous talks between CRED and other wealth management companies did not materialize, the potential acquisition of Kuvera demonstrates CRED’s unwavering commitment to becoming a prominent player in the wealth management space. As CRED continues to process a third of all credit card payments in India, the acquisition of Kuvera represents a strategic move to capitalize on the immense opportunities offered by the mutual fund category.